A bit of history you should know

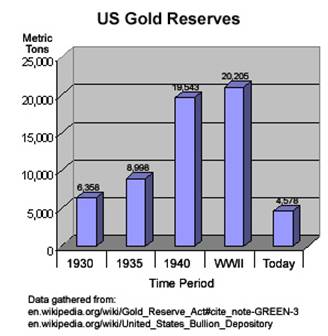

Throughout WW1 and WW2 the U.S. accumulated massive amounts of gold and silver through trade with Europe who were entangled in debt financed wars.

Coming out victorious in WW2, boasting roughly 50% of global GDP, with a massive gold pile & with a solid promise of convertibility to gold & silver, Europe & the world tied their currencies to the U.S. Dollar.

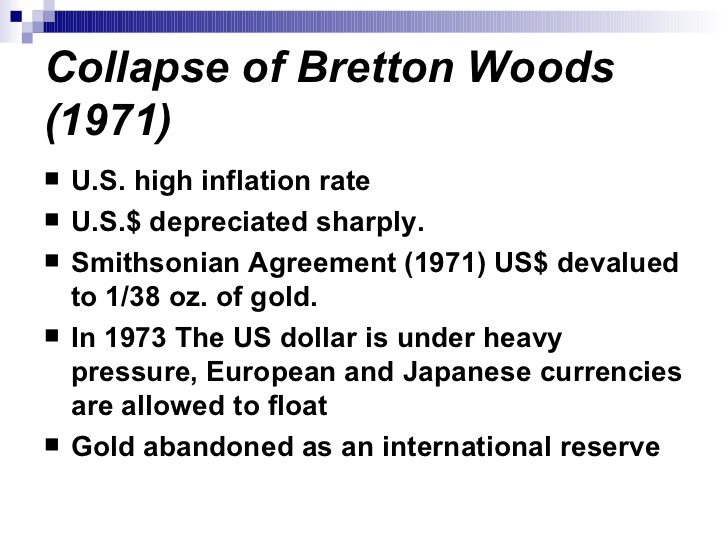

This was called the Bretton Woods Agreement.

Bretton Wood held until Nixon defaulted on it’s promise, and would no longer honor the U.S. dollar’s convertibility to gold.

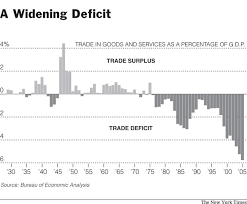

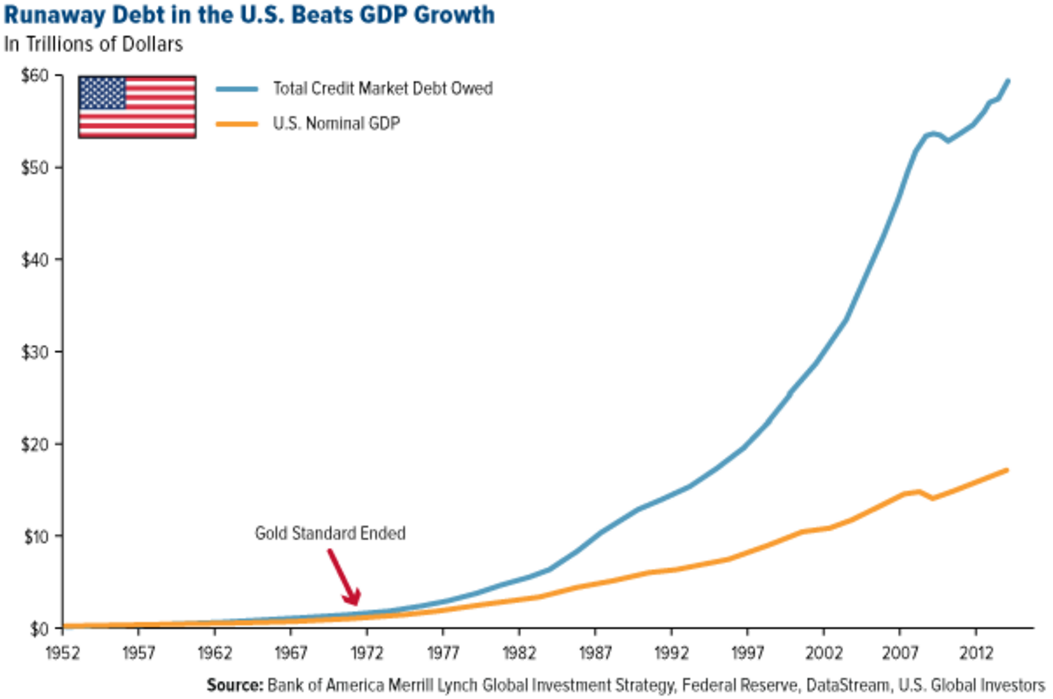

After Nixon, with no more ‘tangible restriction’ that the gold convertibility required, the undisciplined creation of Federal Reserve Debt Currency Notes began in earnest.

And the value of the dollar devalued drastically.

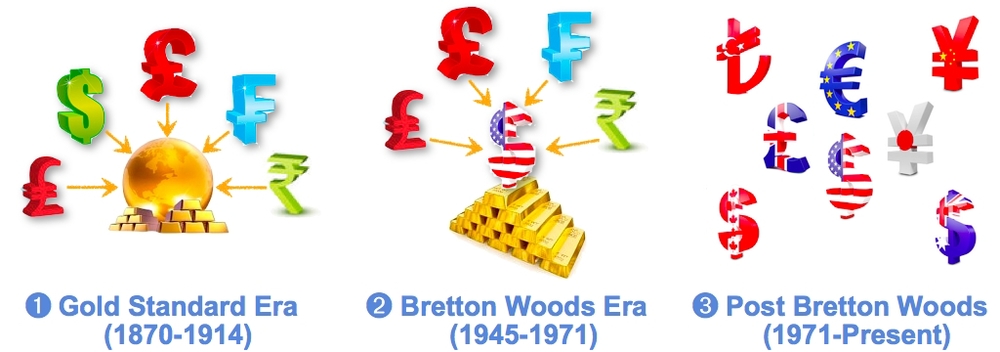

Before Bretton Woods countries generally settled trade in gold. After Bretton Woods countries settled trade in the U.S. Dollar which was convertible to gold. Since the end of Bretton Woods countries continue conduct trade in U.S. Dollars had hold reserves of both U.S. Dollars and Gold. Our Current System would never have come into existence without the initial promise of convertibility to gold.

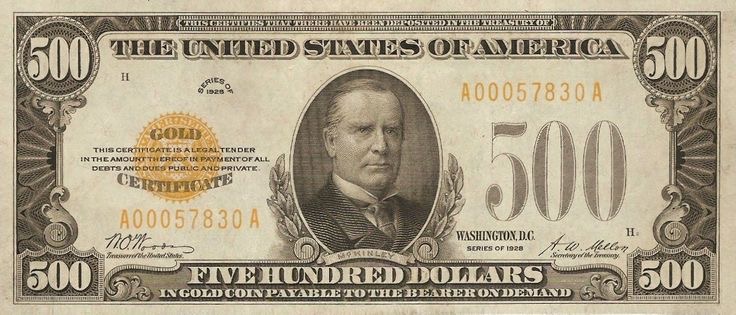

This is what dollars used to say, when they were promissory notes, payable upon demand.

$5 Silver Certificate

$100 Gold Certificate

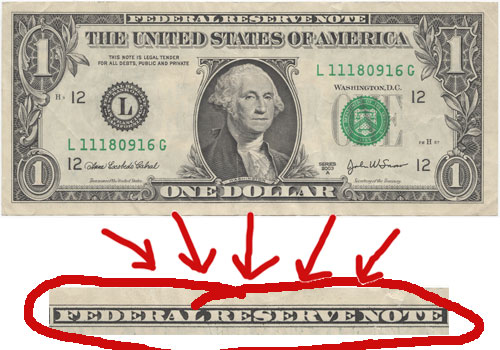

Now we have this debt currency; the Federal Reserve Note

With no physical backing they are created as fast as a printing press can print, and as easily as adding zero’s onto a number on computer screen.

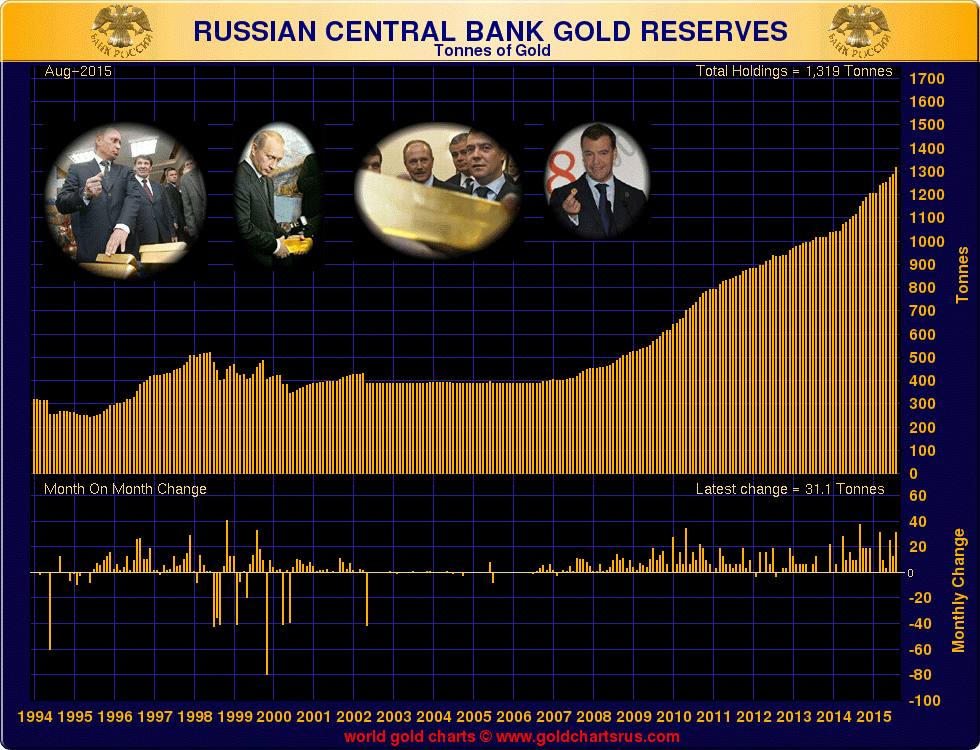

This explains why many of the U.S. Trade Partners have a systematic approach to accumulating gold and silver and other tangible assets using their earned FED Notes, rather than just hold these IOU’s with no defined value. You should do the same.