Debt Saturation explains why even though the central governments of the world have increased the issuance of debt, we are NOT getting another reflationary boom.

They are either going to have to double down and increase their efforts to inject debt currency into the economy much greater than they have or there will be a contraction and a restructuring.

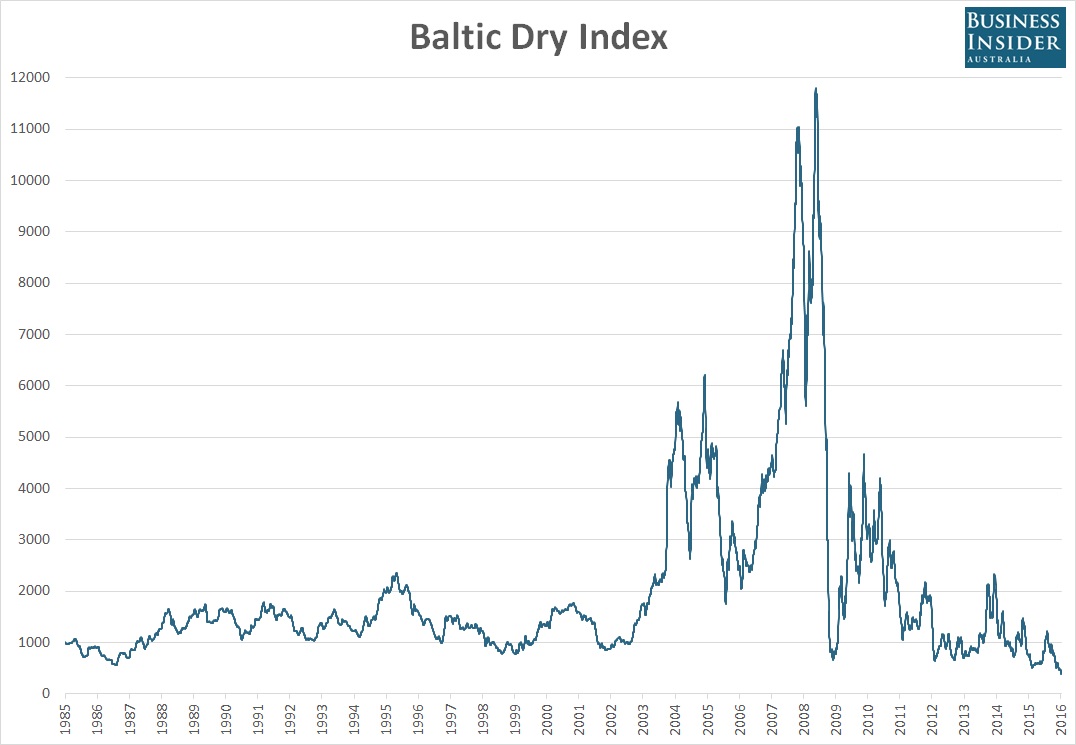

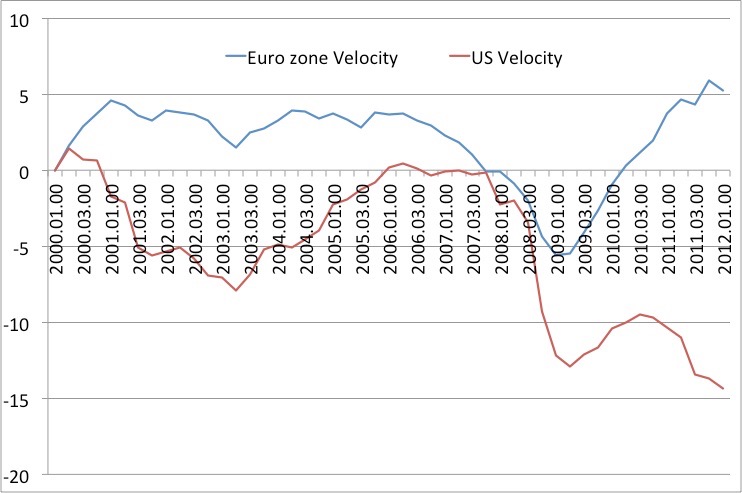

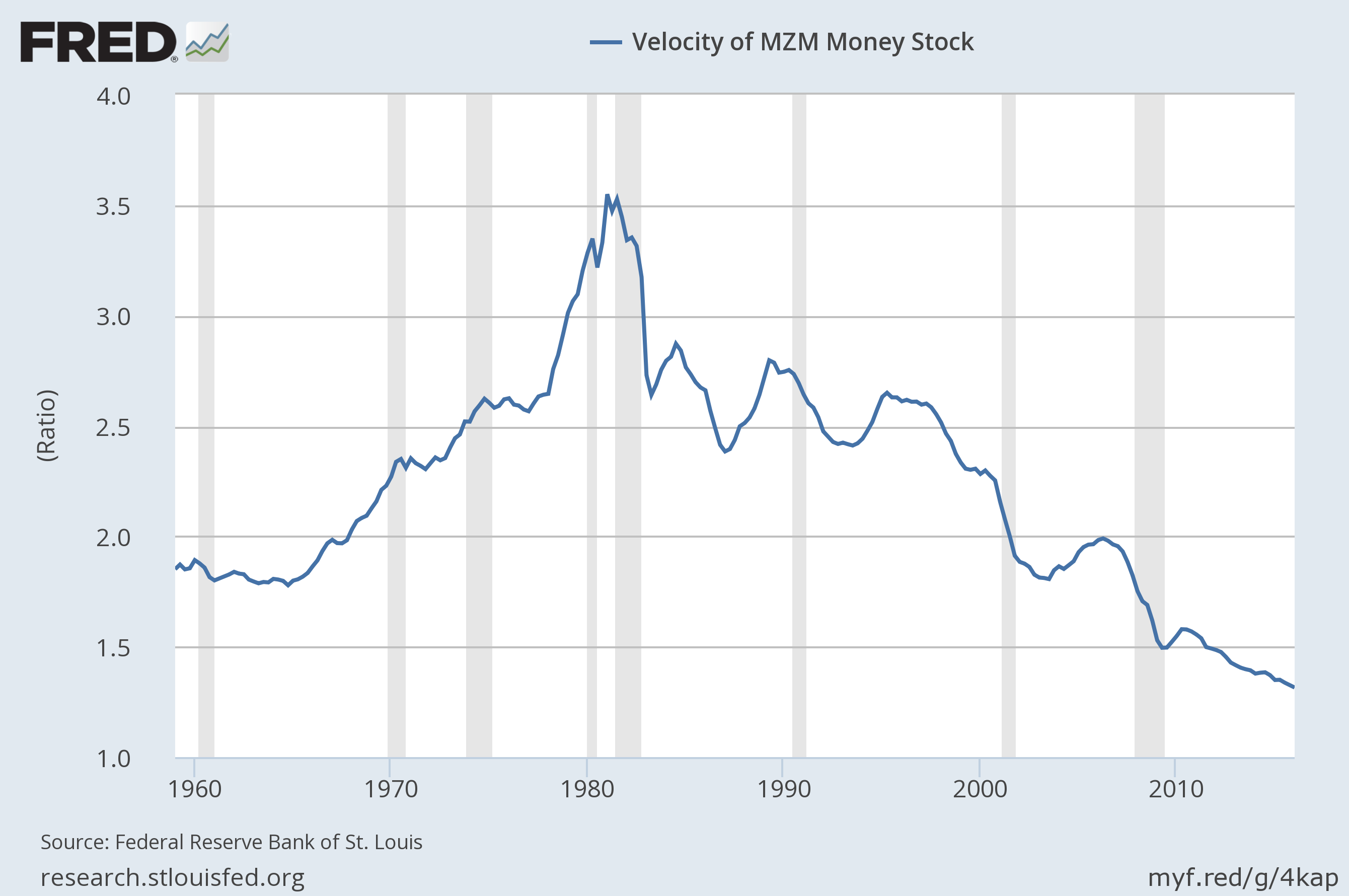

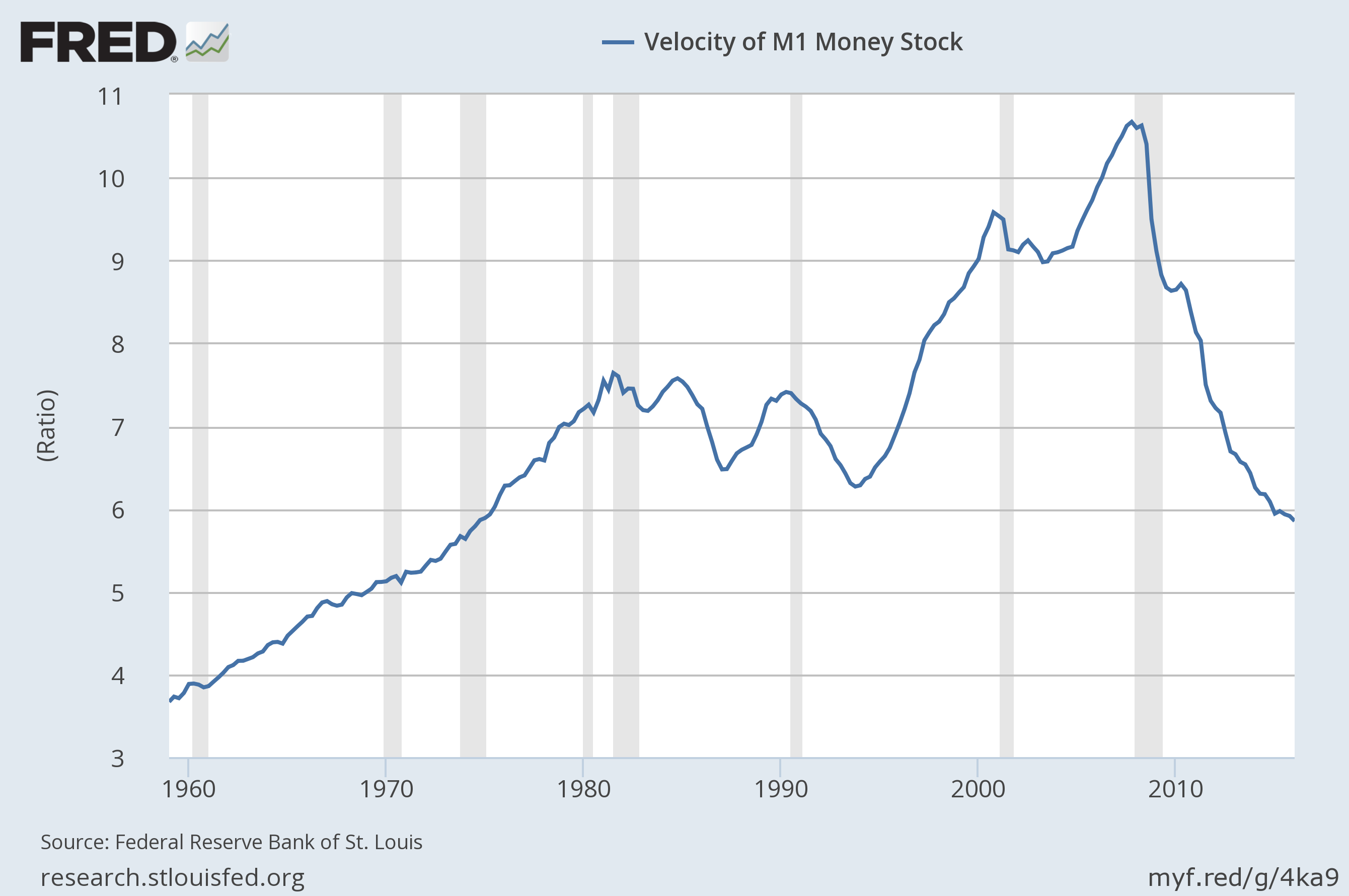

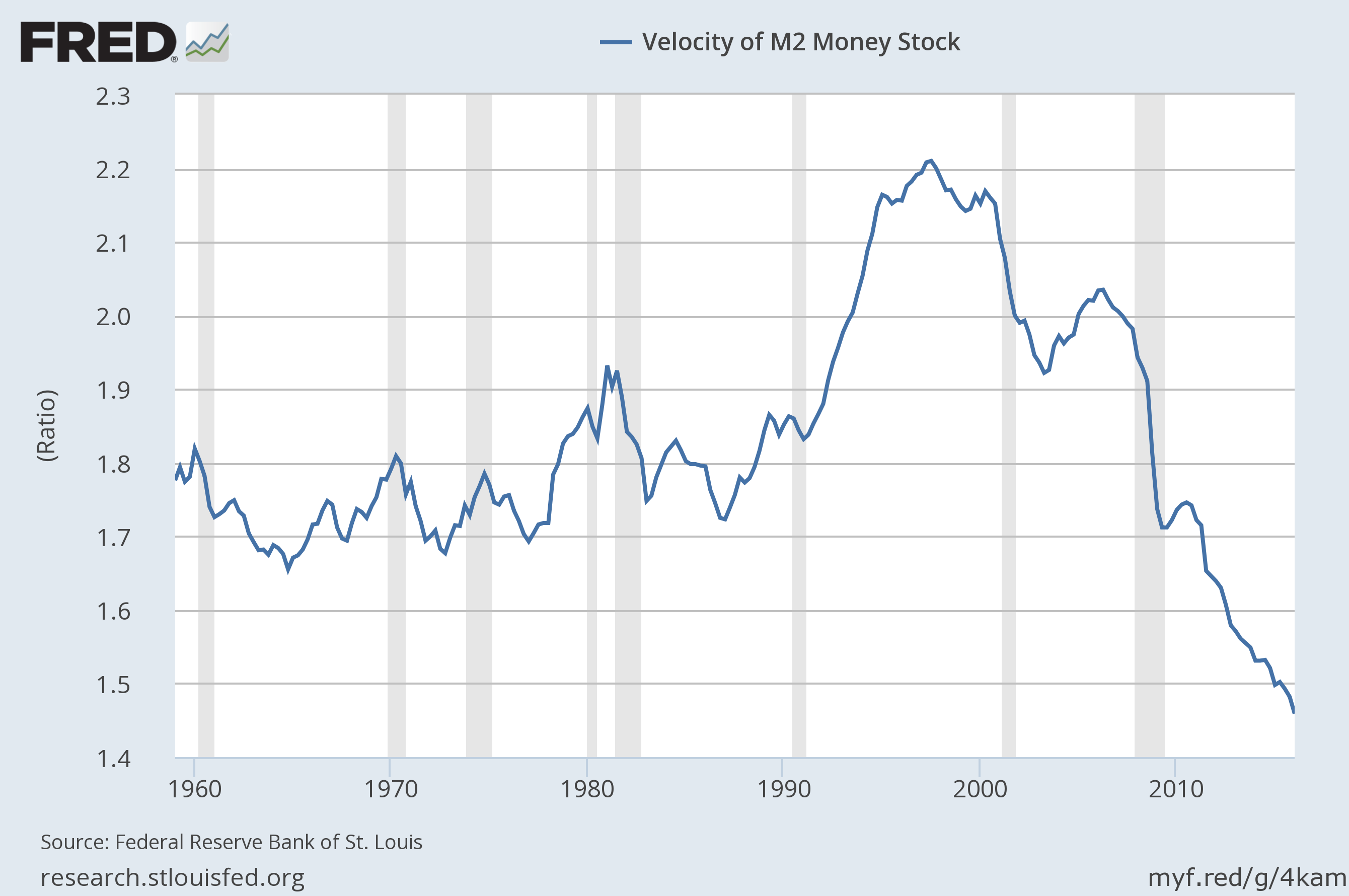

This is why I believe the Baltic Index, Consumption, Spending are down. Look at the last charts that show the velocity of currency.

Velocity of Money is the times that currency turns over in the economy, passing from one user to the next.