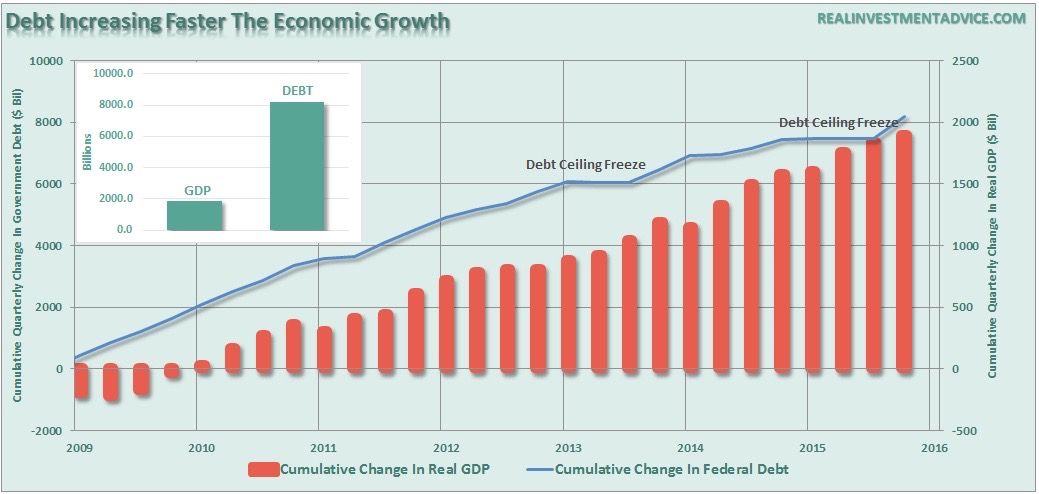

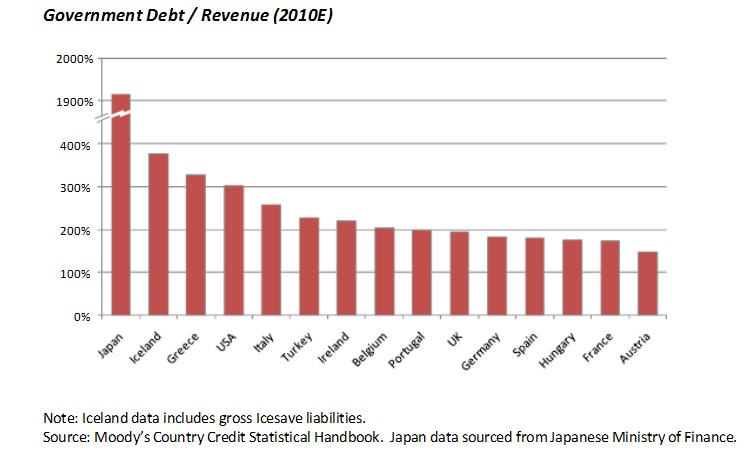

It has quite a bit to do with the Debt to Income Ratios.

For the Country the Debt to GDP Ratio.

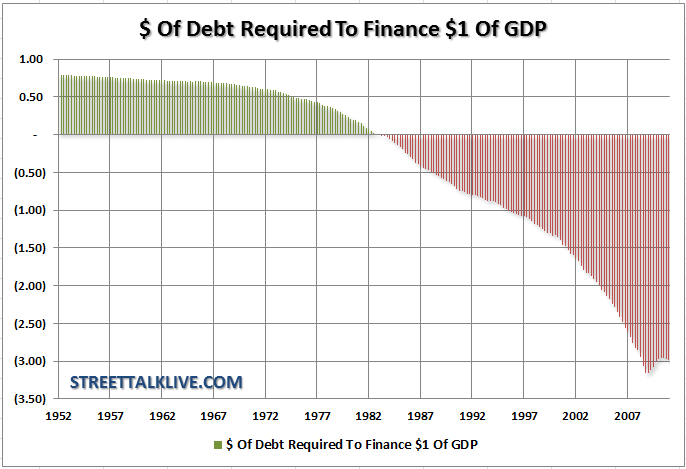

One can get a new credit card to pay off old credit card debt, but to continue to rotate the debt while adding to the principal owed is only a short term solution.

This applies to an individual, a corporation or a country.

Right now the U.S. is getting to the point where they are getting new credit just to pay off the interest on the accumulated debt, all the while continuing to add to the principal. –and those rates adjustable! Right now they are the lowest that they have ever been if they rise then the bankruptcy comes quickly, perhaps immediately. If rates stay low, or even go negative that will only delay the inevitable.

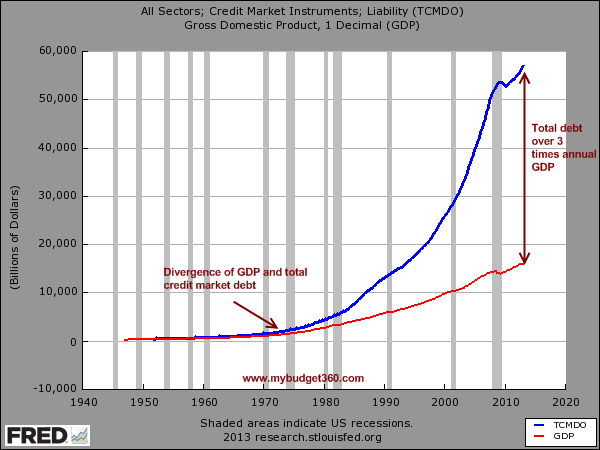

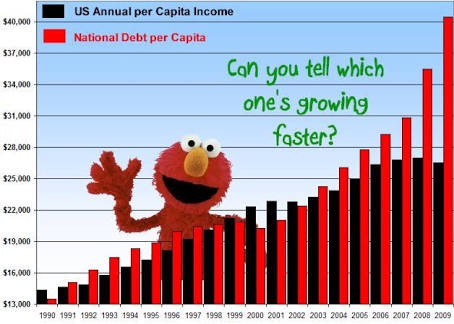

Note in the chart below the point in which we begin to get exponential growth in the chart; 1971. When Nixon defaulted on the gold/dollar connection.

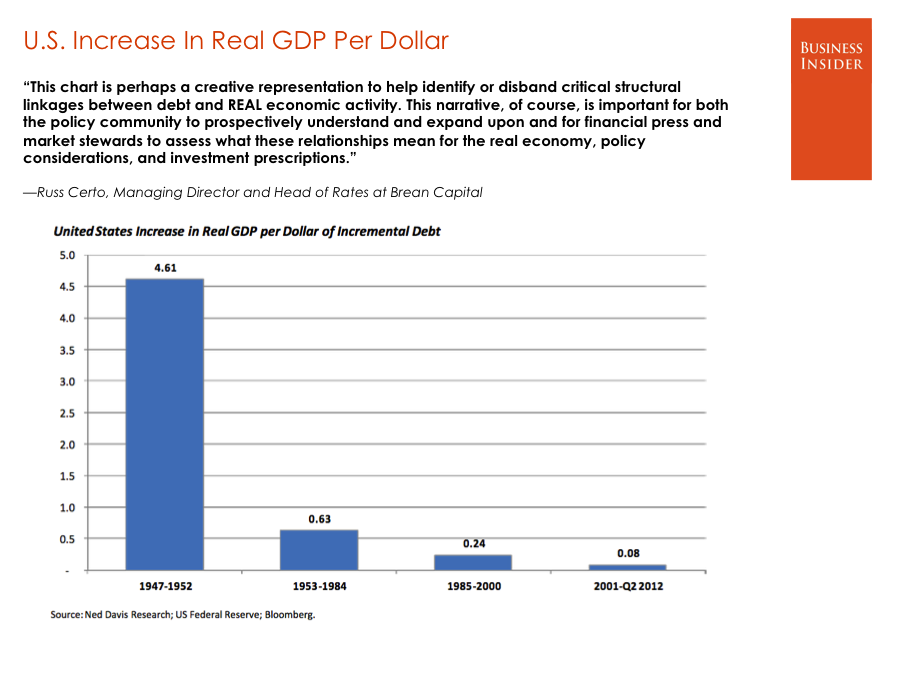

You can see that debt was very productive when there was a natural limitation with the dollar being connected to gold (until the 70’s) and silver (until the 60’s).

This chart is older, but you see the principle.

Eventually this makes the Debt/Government Revenue burden so heavy it becomes unbearable.