What you need to know

There are limitations to how much debt you as individual, as a family, as a community, as a country can shoulder. We are at that point now, or very close to it.

This is explained best with learning about ‘Debt Saturation’. The point at which any more additional debt is counter productive to the health of your finances.

When enough people, companies, institutions and governments reach that point, then the ‘transition point’ begins. This is what Billionaire Ray Dalio refers to as the end of the 75-80 year ‘Long Term Debt Cycle’.

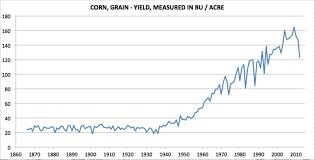

Debt like manure, in the right amounts, can help increase your productivity. For example the yield per acre of farmland can go up with the right amount. Depending on the starting level, adding more manure can even increase the yield per acre further. However too much debt, like too much manure can become negative. –every farmers field in the world has a manure saturation limitation.

In May 2016, a number of horses died at the Pimlico Race Track, many horses have collapsed after races. Their bodies can only be improved upon so much. And the output of those improvements decreases the more that they are administered. Their improved speed is measured in merely milliseconds at that high race track level. The initial ouput, the improvements of the horse relative to input (improved diet, training etc) are greatest early on, then decreases in percentage terms, and the input is increased too much can go negative.

Like steroids for an athlete, a bit will improve their performance, won’t immediately & visibly damage them, but too much will hurt and damage them visibly and probably immediately. –although I’m no doctor or health expert….that is what I’ve come to understand.

This is called ‘Pushing on a String’. Central planners of the world are pushing our collective string now.

If debt is for consumption only, in other words it doesn’t increase your productivity then it is like an anchor dropped off your financial ship while you want to sail. Consumption debt is purchasing a larger T.V., seeing a movie, buying more clothes, shoes, gadgets that don’t help you.

Productive debt would be financing the purchase of another machine that allows your business to produce more widgets for your customers because you couldn’t keep up with demand. Productive debt would be used to build a bridge that cuts down transportation time and expenses for thousands of commuters. Non-productive debt would be a ‘bridge to no where’. –Yes, they spent over $1 million on it in 2011

But remember that even good productive debt, as the level of debt increases the ‘productivity’ of it, the usefulness of it decreases, and can eventually become a negative. At this point even if your bank would like to give a loan you shouldn’t take it. –especially if there is leverage involved!

In a debt based currency system, when it’s usefulness decreases the ‘Velocity’ of currency decreases (the amount of times it changes hands) eventually there is less circulating which leads to a deflationary contraction, and potentially a collapse.

Since the private sector collapse of 2007/2008 the FED & the U.S. Government has ‘force fed’ Debt Currency into circulation knowing the if they did not a great contraction, deflation, and a forced restructuring of the economy would begin. The ‘Long Term Debt Cycle’ would end. This is one of the ‘Support Pillars’ to keep this current system operating.

If they didn’t ‘Force Feed’ currency into existence (through government issued debt), currency as we know it would cease to circulate and change to the system they are surviving on would end.

However the FED & the U.S. Government Debt Spending also have limitations, a debt saturation limit –and I believe we are at that point now, or are quickly reaching this juncture. And when the next crisis comes we will again be faced with restructuring. That it is coming, in my opinion, is a mathematically certainty.

Links

Manager of the Bank for International Settlement on limitations of Central Banks.

Business Insider on Debt Saturation