What you need to know

Fractional Reserve Banking is how commercial banks can lend currency into existence, by leveraging deposits and assets as collateral. The ‘collateral’ they hold is required, these are called ‘Reserve Ratios’.

The ‘Reserve Ratios’ are there to cover any redemption of funds by depositors, and for any losses.

Through leveraged debt issuance, currency is brought into existence.

Banks can choose who they lend to, how much they lend to, and the terms.

Banks leverage your deposits but charge interest on the total debt created.

This system works well only in inflationary expansions, but is harsh & dishonest during deflationary contractions.

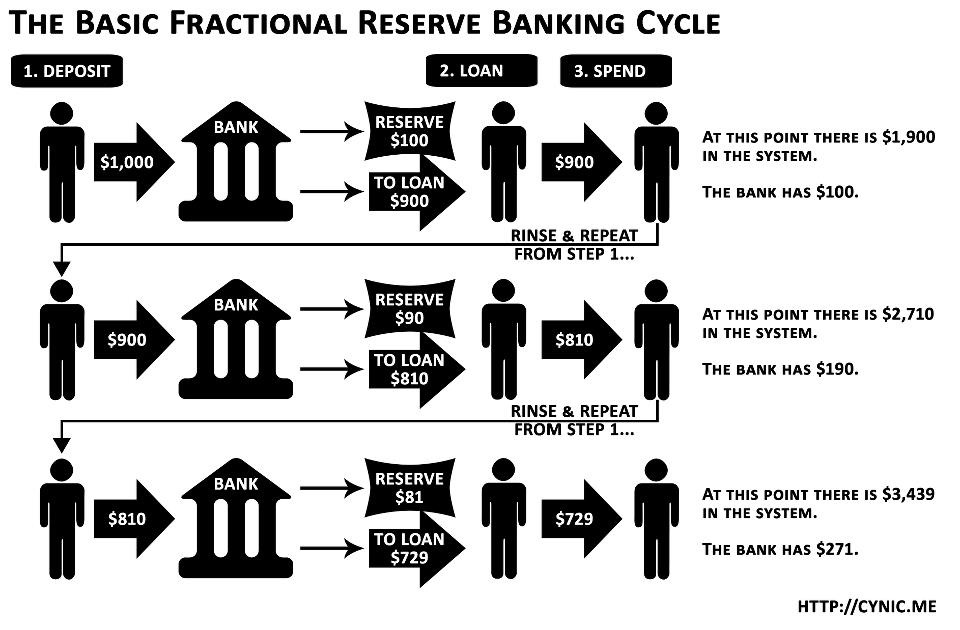

For simplicity sake lets say that the reserve ratio is 10%.

This example does NOT go into the interest charge, which the bank collects on the TOTAL debt created, around $10,000 by leveraging your $1000 deposit.

If they charged a simple 10% APR on the $10,000 created that would be $1000 purely in interest, and if they paid you 10% APR for your deposit that would be a $900 interest profit for the bank.

You can see how banking can be so profitable, by using what is not theirs, with a promise to have it always available they can leverage up and create

Below I break this down for you.

If you, the customer, deposit $1000 into a Bank, the Bank must keep 10%, $100 on hand, and the Bank can now then lend out up to $900 of your deposit to Customer B.

On the balance sheet of the bank it looks like this:

|

BANK BALANCE SHEET |

|

| Asset | Liability |

| Reserve from You $100 | Deposit of You $1000 |

| Customer B Loan $900 | |

| TOTAL ASSETS: $1000 | TOTAL LIABILITY: $1000 |

And…..

|

YOUR BANK STATEMENT |

|

| Asset | Liability |

| Deposit at Bank $1000 | |

| TOTAL ASSETS: $1000 | TOTAL LIABILITY: $0 |

Customer B deposits his $900 loan into his bank account account, which is at the same bank as yours. The bank can repeat the process and set aside 10% of Customer B’s deposit $90 and loan out the remaining 90% $810 to Customer C balance sheet looks like.

|

BANK BALANCE SHEET |

|

| Asset | Liability |

| Reserve from You $100 | Deposit of You $1000 |

| Customer B Loan $900 | |

| Customer B Deposit Reserve $90 | Customer B Deposit $900 |

| Customer C Loan $810 | |

| TOTAL ASSETS: $1900 | TOTAL LIABILITY: $1900 |

This process can be repeated over and over again

|

BANK BALANCE SHEET |

|

| Asset | Liability |

| Reserve from You $100 | Deposit of You $1000 |

| Customer B Loan $900 | |

| Customer B Deposit Reserve $90 | Customer B Deposit $900 |

| Customer C Loan $810 | |

| Customer C Deposit Reserve $81 | Customer C Deposit $810 |

| Customer D Loan $729 | |

| TOTAL ASSETS: $2710 | TOTAL LIABILITY: $2710 |