What you need to know

The U.S. Treasury auctions off Government Issued Debt. Primary Dealers are required to submit bids on all government debt auctions. The Federal Reserve basically back-stops/bank-rolls Primary Dealers. .

This is a massive ‘Support Pillar’ that holds up the current system.

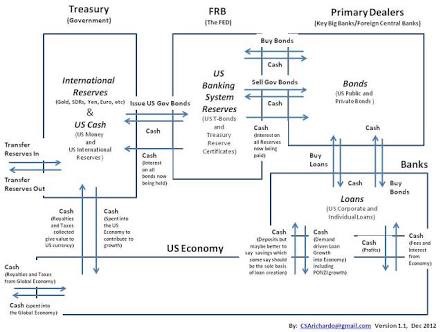

The chart below is a bit difficult to understand but it’s worth seeing the inter-connected, closed-loop support system in place so that there will never be a failed U.S. Treasury Government Debt Auction.

The deal that the FED has struck is to be the lender of last resort for the U.S. Government and create a way for ‘Debt Currency’ to always be force fed into the economy to support the system.

But this system leads to compounding growth of the debt principal, plus interest on the debt (which I show as a great risk in the Risks Report, and we are getting to the point where the solvency of the Federal Reserve Balance Sheet is going to be questioned. (I go over that in another lesson)

This 8 Minute Video explains the U.S. Treasury Auction Process in simple terms.