What you need to know

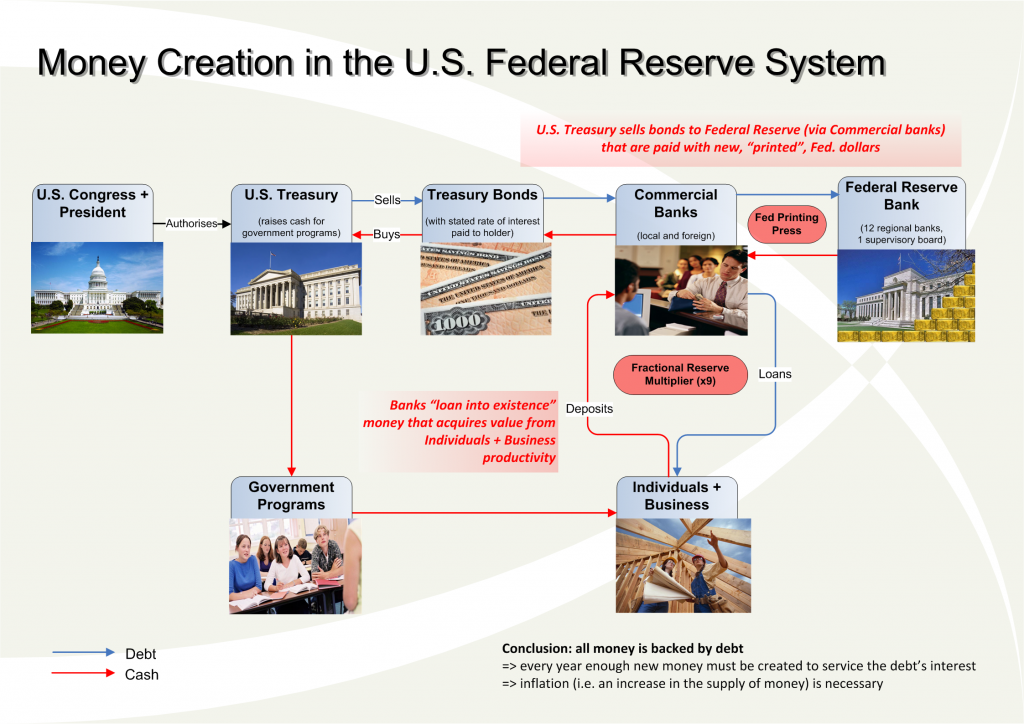

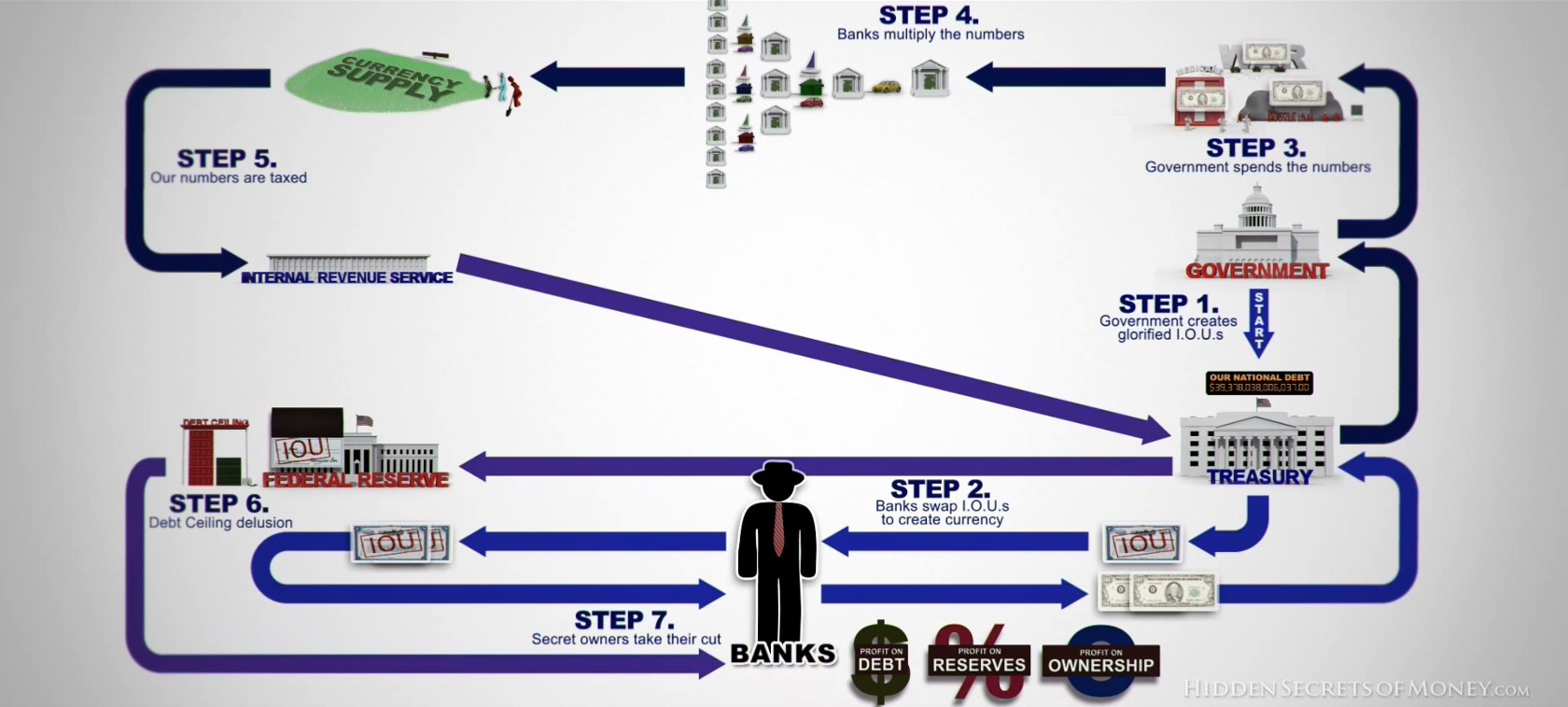

There are a number of ways debt currency enters the economy, the largest is through government debt/deficit spending, another way is through Fractional Reserve Lending.

Government creates a IOU, and that promise to repay with interest can be turned into freshly created currency.

The graphs below should be helpful in understanding this process.

When Federal Reserve (or any central bank) buy IOU/Loans/Debt Contracts (a Treasury Bill, Note or Bond) with currency they create out of thin air they can thereby inject currency into the financial sector & give to the government (indirectly).

The Federal Reserve can lend directly to banks, or any other company they wish.

When the FED buys (through Open Market Operations) a debt security (IOU/loan like a Treasury Bill, Note or Bond) with their newly created currency it is just a ledger entry on their own balance sheet on the liability side, just numbers that they input with a keyboard. (FED BALANCE sheet here –notice it says ‘unaudited’)

On the FED’s Balance Sheet this purchase of a debt security becomes an asset, and the currency (which they create out of nothing) is on the liability side.

|

FED Balance Sheet |

|

| Asset | Liability |

| $100,000 U.S. Treasury Bill |

$100,000 Federal Reserve Notes (AKA $) |

| TOTAL: $100,000 | TOTAL: $100,000 |

When a financial institution sells a debt security to the FED, that sale becomes a cash asset on the financial institution’s balance sheet.

Remember! –When more and more debt is created our currency supply increases.

When debt is paid back or defaulted on the currency supply decreases.

Links:

The Federal Reserve Board Website Explaining the ‘liability’ of their own freshly created currency

This chart below shows both the Commercial Banks Fractional Reserve & the Government Issued Bonds becoming fresh currency.