What you need to know

Debt currency is not ‘static’. It is not a stable, neutral, unbiased store of value. Because debt is currency, it has it’s own supply & demand variables, it own dynamics that do not make it a good money and good store of value.

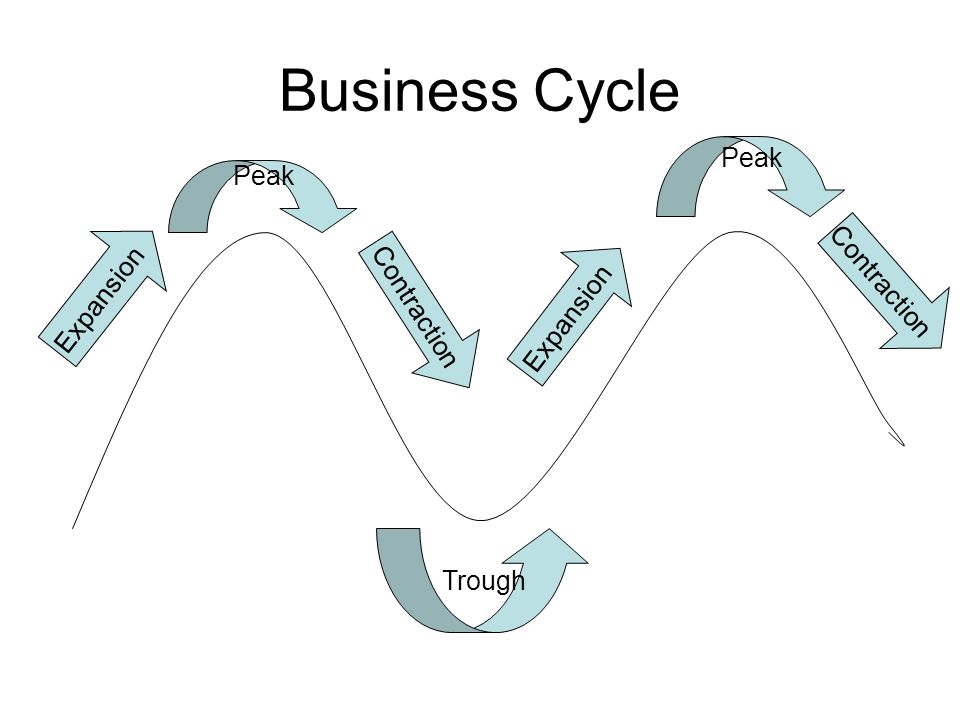

When debt issuance is plentiful incomes & assets prices increase (at least in inflated currency terms). Currency is circulating steadily and changing hands frequently. People feel confident in their ability to get currency units in the future and often take on more debt, a self sustaining support ideology sets in. (remember…’Home Values always rise’ circa 2005/2006). This is when currency shows purchasing power weakness, but people have lots of them. Abundant debt currency issuance is inflation. Rising prices is a symptom, a reaction to the increase in currency units.

When a contraction in the issuance debt begins, there is less currency is in circulation. But promises to repay principal and interest have only increased dramatically the longer that the debt currency expansion went on. So just as in the ‘musical chairs game’ there is a scramble for currency. Spending is curtailed, velocity of money decreases, debt is paid back. This is when currency shows relative strength; this is deflation.

One of the ‘Support Narratives’ that enables and supports this system is the ‘Constant Scarcity’ environment that a debt currency creates. Since there is never enough around both in inflationary times and more acutely in deflationary times it creates a mindset around money. It keeps people fearful, worried, struggling, confused not knowing which way the wind is blowing at any particular time.