What you need to know

The Federal Reserve may be able to produce one more short term expansionary cycle with this debt currency but the FED has already reached it’s ‘Debt Saturation’ limit.

It is either already insolvent or will be soon!

DEFINITION of ‘Accounting Insolvency’

A situation where the value of a company’s liabilities exceeds its assets. Accounting insolvency looks only at the firm’s balance sheet, deeming a company “insolvent on the books” when its net worth appears negative.

They have already committed suicide, slit their balance sheet’s wrist, like a gambler they have ‘put all their chips on the table’, and have doubled down. Even though that may not be clear yet to all, the arithmetic is clear and does not lie. They have put themselves in an untenable position and it’s only a matter of time before this becomes clear to all.

They are using what they call ‘Forward Guidance’ & ‘FED Transparency’ (which is currently acceptable Propaganda) to push the following ‘Support Narratives’.

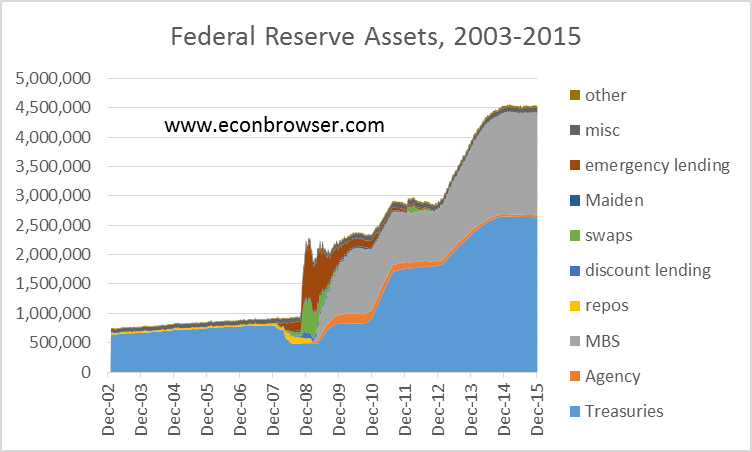

- They tell the world that at some point they will return their balance sheet to normal. –However in preventing the natural restructuring from occurring in 2007/2008, by exploding their own balance sheet in buying massive amounts debt securities, they have become the largest player in the Government Debt market that they have become the market. In fact at this rate of accumulation the FED will be the sole owner of government debt. Any buying they do will move the market interest rates down, and selling they do will move the market interest rates up. At the current rate of growth the FED will own ALL the U.S. Treasury Debt.

- They are continually going back and forth between signaling the market that they will raise rates or they won’t raise rates, claiming to be ‘Data dependent’. The truth is that they will never be able to raise rates to historical norms (and in real terms-above inflation) because if they did they would bankrupt the U.S. Government, by making even just the interest payments on the enormous principal balance of the U.S. Deficit un-payable. –This is one of the great Risks that I show in compounding, exponential charts at the ‘Risks/Rewards Page’ Here.

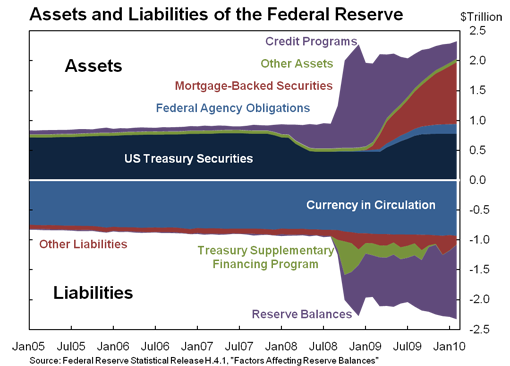

The traditional way the FED handled higher inflation was selling debt securities into the market to ‘mop up’ excess currency making currency more scarce and cause a ‘tightening’. But in a higher interest rate environment, if the FED sells the debt securities they have accumulated at lower rates they will take massive losses on their balance sheet that would render them insolvent.

When, and, or if, inflation starts to rise & they try and sell securities to normalize their balance sheet they will be faced will losses, insolvency & maybe bankruptcy. Confidence will probably be lost well before then. Their only hope is to hold the debt they have bought until maturity, and increase their holdings but that too is not viable option indefinitely.

On a balance sheet your Assets minus your Liability equals your Equity, your Net Worth. –this needs to stay positive.

If the FED sells for 50,000$ a debt security that it bought for $100,000 it must take a loss.

This is why Fischer FED official publicly expressed ‘angst’ about the FED Balance Sheet

This chart below is from 2005–2010