When banks leverage deposits and assets, by issuing more debt it increases the currency in circulation.

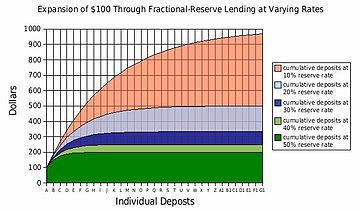

You can see below that the lower the reserve rates are the more currency can be brought into circulation through issuance of debt.

Central planners can lower reserve requirements in the hope to expand the currency, they can also raise them to try to contract or reign in when they perceive that the expansion is getting out of control.

This graph helps to show the structural weakness, inherent flaw in the fractional reserve banking system.

The depositors believe that their funds will be available on demand, however it is lent out and is leveraged.

When the bank takes losses on loans (which is often part of the natural ‘Business Cycle’), or too many depositors move their funds out of the bank then someone is left with a promise broken; a deposit that cannot be redeemed.

The ability to leverage deposits and increase the currency through the issuance of debt is powerful on the way up, in an inflationary expansion.

However it is just as powerful, if not more powerful & quick on the way down, in a deflationary implosion. Because confidence takes many years to build up, but only seconds to lose.