What you need to know

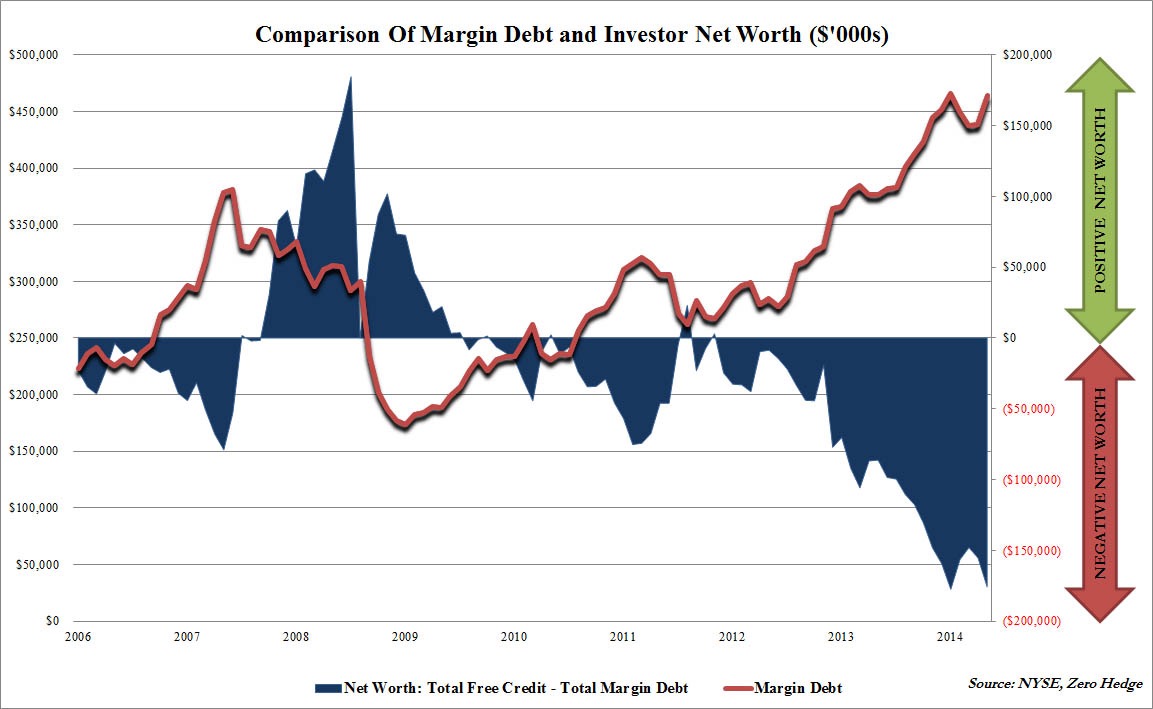

Margin is a Debt. Debt must eventually be paid back, renegotiated or defaulted on (unless you are government you can issue currency by issuing more debt.)

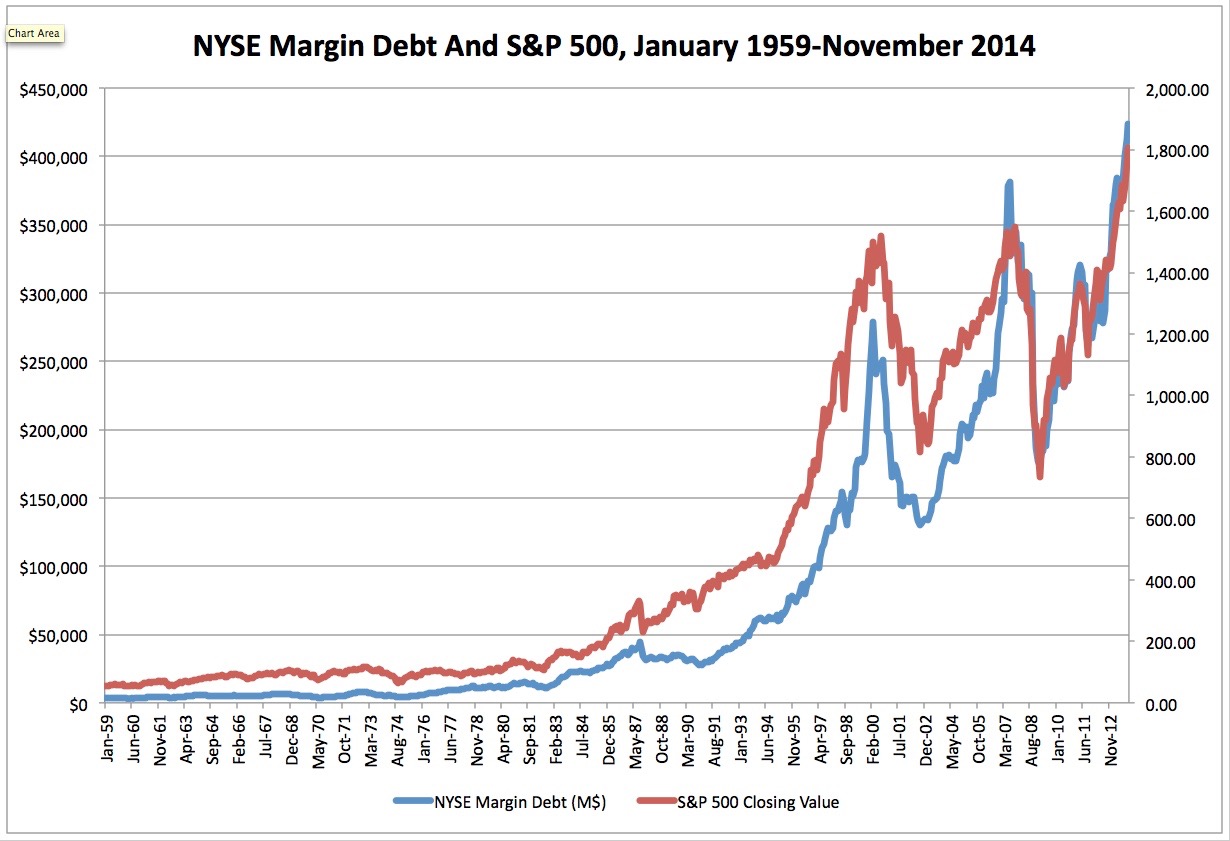

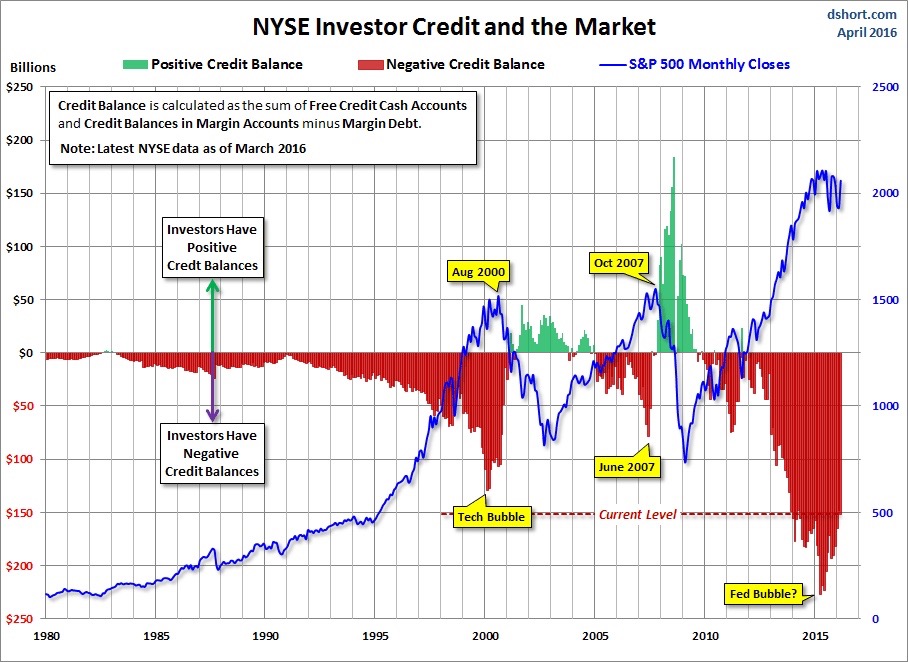

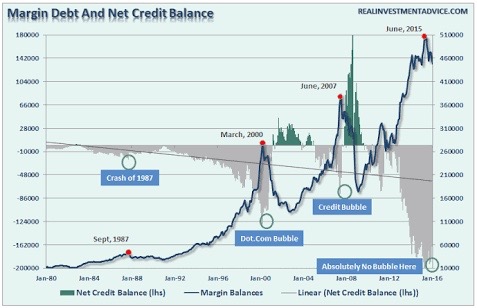

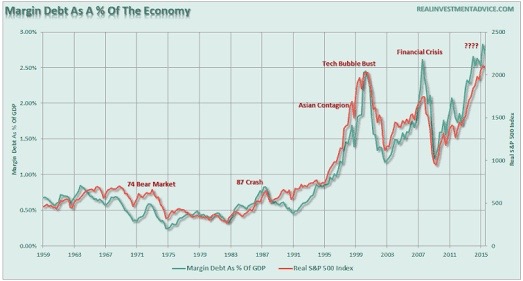

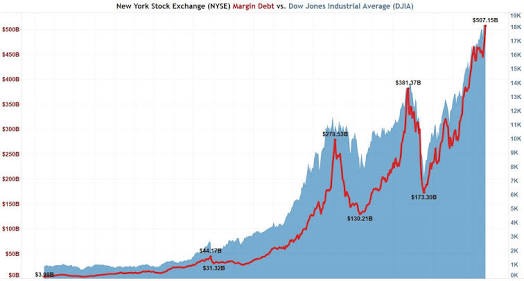

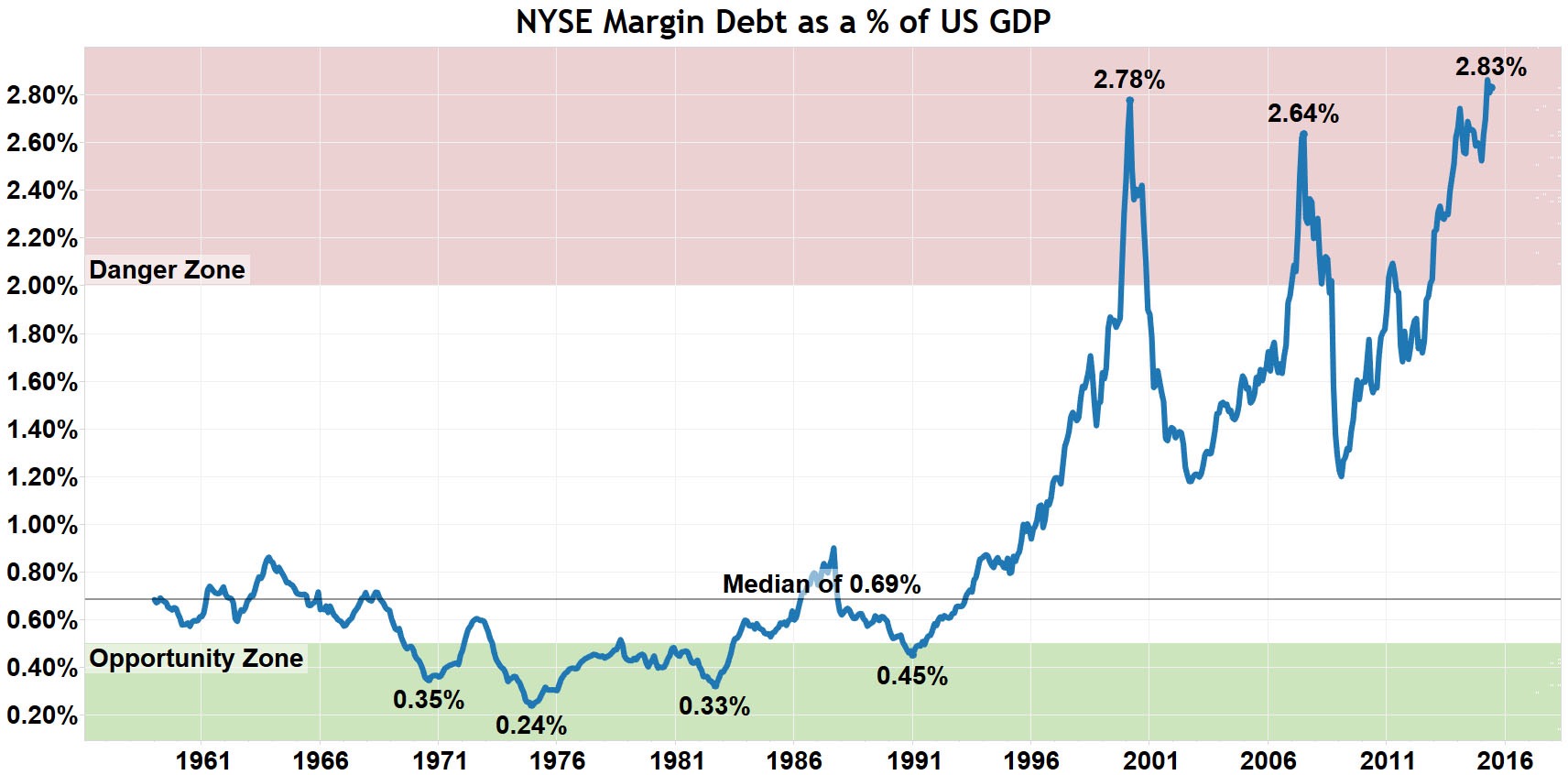

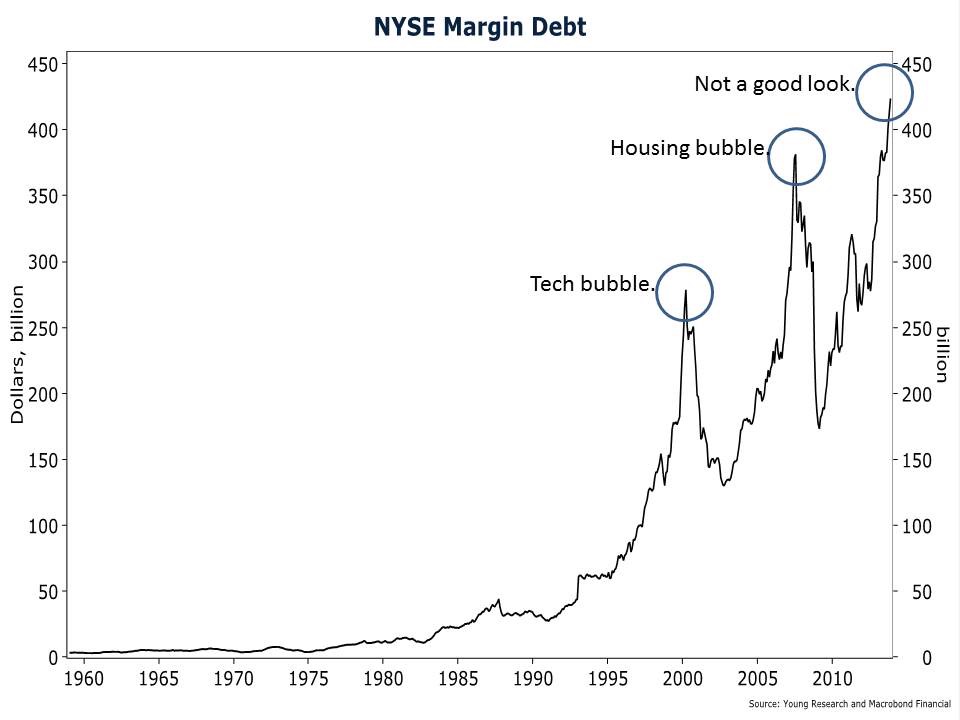

With a ‘Margin Account’ an investor/trader/speculator can borrow the brokers money to place trades much larger than the cash amount in their account. This is a great tool to determine ‘Market Sentiment’ and to see when investors have over leveraged themselves. We are at or breaking all time ‘Margin Debt’ highs, which has a close correlation with violent moves down.

This works well as long as assets are moving up, people trickle in over time, but when momentum slows, people start heading for the exits at the same time and this forces liquidations.

What is a Margin Account?

Think of a casino giving a wealthy gambler ‘credit’ to play with more than he brought. If he does well he walks away with more, if he does bad he owes the casino.