What you need to know

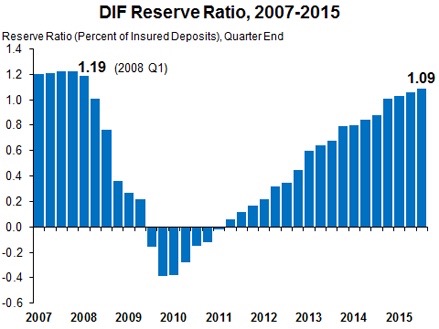

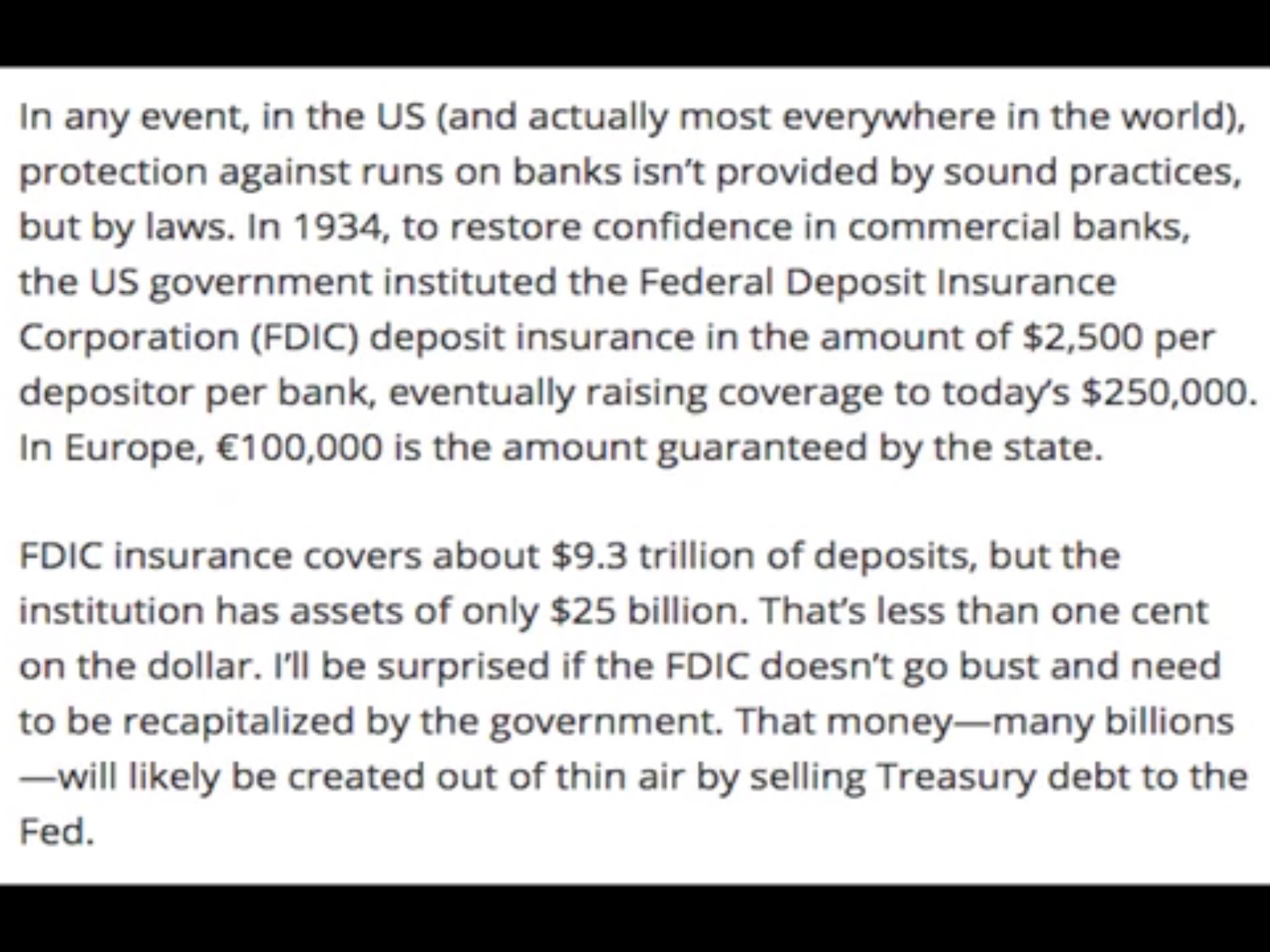

The FDIC only has a tiny fraction of cash on hand to cover the ‘insured’ accounts. In 2014 it had a bit over 1% ‘Reserve Ratio’, cash to insured accounts. They admit themselves they will probably not be back to statutory minimums anytime soon.

A small run on banks, a crisis, the FDIC will most likely have to go to the U.S. Treasury / U.S. Congress to get additional funding. By the time you have those funds they will have devalued through the dilution of massive amounts of new debt currency created and crisis of confidence this act alone would start.

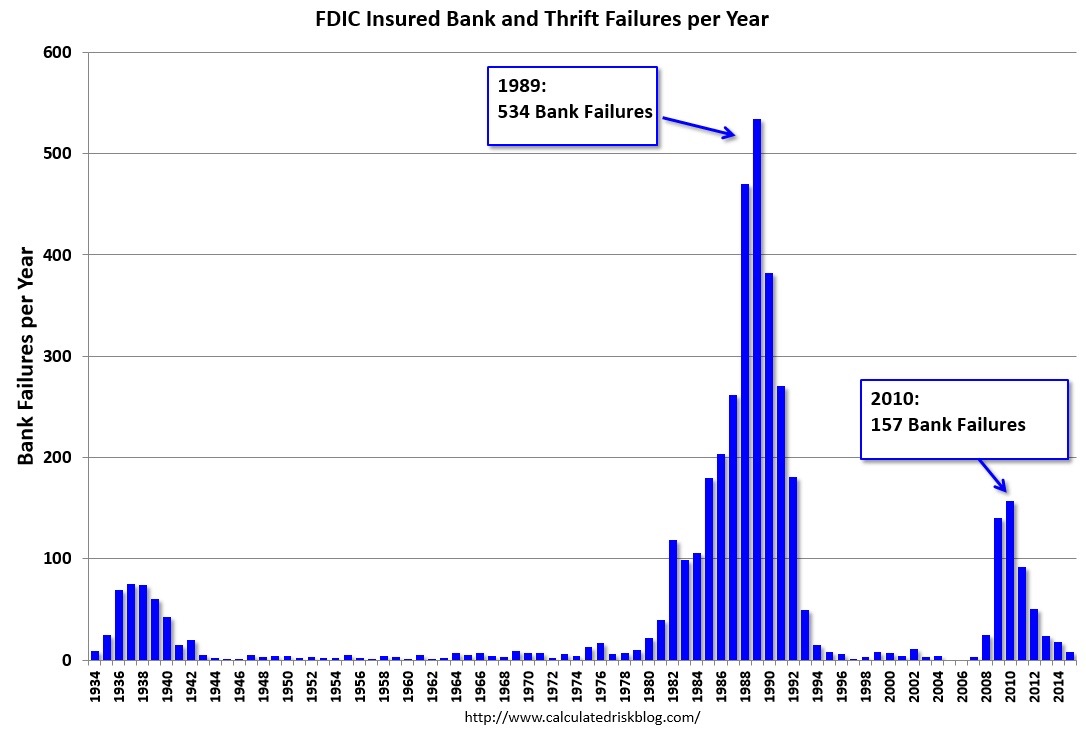

During the last crisis they went to negative levels. Through forced & financed mergers and bankruptcy the banking system survived. However the problems that created the last crisis have only increased in size since then so the next crisis will be much larger.

The FDIC will not technically ‘Run Out of Money’, as this Bloomberg article explains, however they will be forced to get additional funding, which means additional debt currency created by Congress and the Treasury, and this act could trigger trillions of U.S. Dollars sold around the world

Before the crisis of 2007/2008 the FDIC insured up to 100,000, that was changed to 250,000.