August 15th 1971 Nixon defaulted on the convertibility of the U.S. Federal Reserve Note (ASA U.S. Dollar). A ‘Crisis Of Confidence’ in the U.S. Dollar began. The definition of a dollar had been suddenly changed.

In September 1971, OPEC issued a joint communiqué stating that, from then on, they would price oil in terms of a fixed amount of gold. This brought the earnings, in real terms, of the OPEC Nations back closer to the Bretton Woods levels.

Massive amounts of U.S. Dollars held abroad were beginning to flood the U.S..

October 6, 1973 the Yom Kippur War began.

October 8-10th, 29173 OPEC negotiations with major oil companies fail link

October 16th, 1973 the OPEC raised prices 70% to $5.11 per barrel.

October 19th, 1973 Nixon request $2.2 Billion for Israel.

By October 20th, the Arab Oil Embargo began.

November 1973 Henry Kissinger & Nixon began negotiations

By 1974 the U.S. promised military and political support for the House of Saud in exchange for a promise that all their oil sales would be conducted in Federal Reserve Notes (U.S. Dollars).

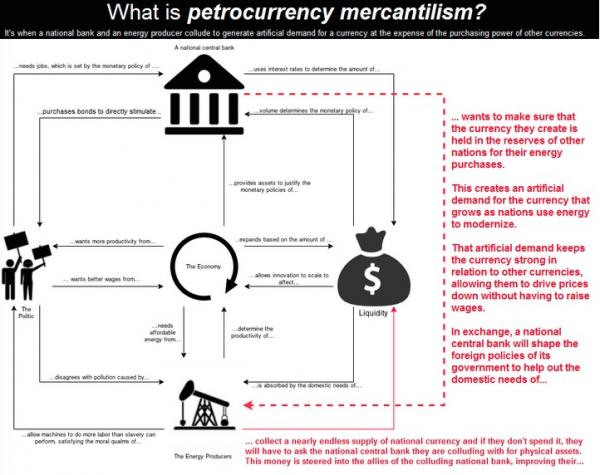

This forced every nation in the world that wanted to buy oil from Saudi Arabia had to first sell their own national currency to buy U.S. Dollars. This created a massive source of demand for the U.S. Dollar abroad. Eventually there would be trillions of U.S. Dollars used in the contracts, forwards, futures, derivatives markets. This agreement has been coins the ‘Petro Dollar’. By 1975 all OPEC Nations were pricing oil in U.S. Dollars. This has allowed for the continuation of the ‘Reserve Currency’ Status of the U.S. dollar.

This forced every nation in the world that wanted to buy oil from Saudi Arabia had to first sell their own national currency to buy U.S. Dollars. This created a massive source of demand for the U.S. Dollar abroad. Eventually there would be trillions of U.S. Dollars used in the contracts, forwards, futures, derivatives markets. This agreement has been coins the ‘Petro Dollar’. By 1975 all OPEC Nations were pricing oil in U.S. Dollars. This has allowed for the continuation of the ‘Reserve Currency’ Status of the U.S. dollar.

This agreement was negotiated by U.S. Treasury Secretary William & Henry Kissinger.

U.S.-Saudi Arabian Joint Commission on Economic Cooperation

Links to other articles below.

For the American Consumer this has allowed a higher standard of living, being able to purchase foreign made goods and services relative to what it would be absent this support system. It has incentivized nations of the world to import into the U.S. rather merely exchange their currencies for USD. It has incentivized individuals and corporations and governments to go into debt, by the steady reduction in borrowing costs, and abundance of funding, and given a false sense of stability to the Debt Currency structure of the Federal Reserve Note system (the U.S. Dollar).

‘Petro Dollar Recycling’.

This is a term used to describe the recycling their surplus dollars back into the U.S. Dollar denominated securities. Stocks, bonds, commodities, and often back into government debt (allowing the government to borrow more and ever lower rates) and into military equipment purchases (funding a large part of the Military Industrial Complex in the U.S.)

If they sell for oil for a profit, and live below their means there will be a surplus of U.S. Dollars. This created a massive demand for the management of those surplus dollars, so at each step of the way financial industry profited.

Results

The militarization of the Arab nations, instability, violence and constant war in the region.

The unwavering political & military support of the House of Saud has been a contributing factor to anti-western sentiment, and terrorism, and the radicalization of Muslims.

Along with millions of lives in the region lost it has cost to the U.S. the many lives of U.S. Citizens lost. As the U.S. Military that stands to make good on the promise of protection for the house of Saud.

This is changing now

- Some countries have begun to move away from pricing oil sales in U.S. Dollars, with bilateral trade agreements.

- It seems that Russia now moves the majority of it’s surplus dollars into gold.

- The U.S. Oil Fracking Industry has brought the price of Crude Oil down, tying up less U.S. Dollars in oil related contracts, and has lowered the available dollars for ‘Petro Dollar Recycling’ by the Arab nations.

- The low interest rate environment creates less incentive to keep dollar assets in low yielding securities.

- Many nations understand the negative ramifications of this support system and are working to dismantle it.

- Many nations know that the U.S. & first world nations have reached the debt saturation points, and that the Debt Currency system is unsustainable and thus change is inevitable.

- Many nations have alternative plans in place so they can seamlessly transition to a gold backed/alternative trade settlement of trade & oil sales.

Links

Secret Saudi Trade Deal Exposes

Bloomberg Article on U.S. Treasury Dealing Saudia Arabia

Nixon Administration Ignores Saudi Warnings, Bringing On Oil Boycott

Other Research done by; Richard Duncan, William R. Clark, David E. Spiro, Charles Goyette and F. William Engdahl